Benefits of Specialisation in Private Equity

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.” Bruce Lee

The Bruce Lee quote above suggests something that we all intuitively understand – specialisation has benefits (and that Bruce Lee probably didn’t skip leg day).

Looking at the private equity buyout capital raised in 2011, technology funds made up 2% of total funds raised. Fast forward to 2021, technology funds made up 16% of total funds raised. These numbers represent large markets such as US, Europe and China. In Australia and New Zealand, where our market is comparatively smaller, the market has historically been served by generalist private equity funds – that is sector agnostic funds. The advantage of generalist funds is flexibility in which sector they pursue based on prevailing trends at the time.

However, at Potentia – the first B2B software and technology buyout fund in Australia – we think the benefits of specialisation outweigh the potentially reduced opportunity set of focusing on a single sector. Furthermore, we believe software and technology has a secular tailwind driving increasing productivity throughout the economy.

The benefit of a technology sector specialist fund include:

- Sourcing and deal evaluation. Deep industry knowledge means we know exactly what we are looking for in an investment and can therefore identify and respond rapidly to investment opportunities. This means that due diligence processes are quicker and more focused on the key issues that matter to a technology company.

- Value creation. Potentia, through experienced investment professionals and operating partners, is able to bring both the generalist value creation tools as well as specialist value creation tools. For example, specialist skills related to product development, migration to cloud, and geographic expansion. Research published in ‘An International Journal of Entrepreneurial Finance’ found that sector specialist buyout owned companies profit increased 7.5% greater than buy-outs backed by non-sector specialist firms.

- Exit. As sector specialists we are proud that the companies that we have identified, and worked with management to improve, have attracted higher valuation multiples on exit.

- Talent. At Potentia, we have found that being known as a software and technology specialist fund, we are able to attract talented individuals at a firm and portfolio company level. Potentia’s team is comprised of former founders of technology companies, software engineers, computer programmers and investment professionals that specialise in software and technology. We have a large network of talented individuals (e.g. CTO, CPTO) that are critical additions to help companies realise their full potential.

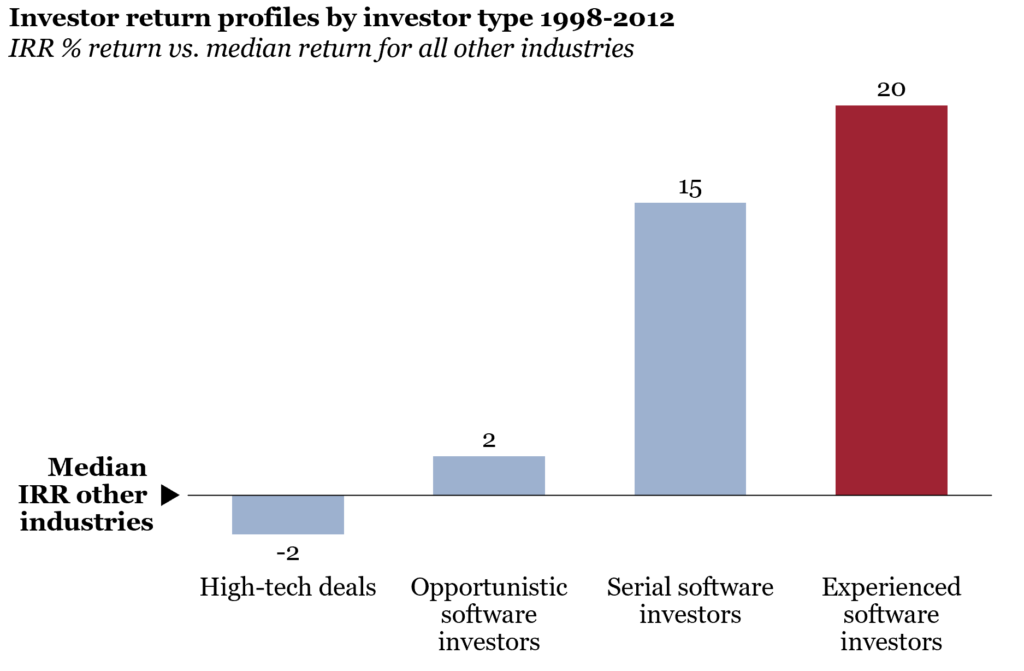

The returns speak for themselves. BCG analysed the returns generated by PE investments in software companies. Software deals outperformed non-software deals by 9 percentage points. Breaking down the experience of PE investors into those that opportunistically invested in software versus those that are serial / experienced software investors showed that opportunistic software investors outperformed median non-software deals by 2 percentage points, while serial / experienced software investors outperformed median non-software deals by 15-20 percentage points.

To round out this article, we are fortunate at Potentia to have a portfolio that is comprised entirely of great software and technology businesses: Micromine (mine planning software), Linkly (payments integration), Education Horizon Group (student and learning management software), Superchoice (superannuation clearing house software), Newbook (property management software), CommerceVision (B2B ecommerce software), Estimate One (construction tendering marketplace software). Exited companies include Complispace (regulation technology) and Ascender (payroll and HCM software).

We look forward to welcoming new portfolio companies into the Potentia family.